- Published on

How to Rebalance Your Portfolio (Free Software Tool)

Hats off to you, anon.

If you're here that means you are an enterprising, self-guided investor taking ownership of their financial future. Managing one’s own portfolio can be stressful, but tremendously empowering. One step in that journey you’ll visit regularly is rebalancing.

Periodically rebalancing your portfolio in a disciplined and consistent manner can be essential for:

- Maintaining adequate diversification and reducing concentration risk

- Adhering to an age and risk-tolerance-appropriate asset allocation model over long time horizons

- Locking in and re-allocate gains to improve wealth compounding (google Shannon's Demon if you want to go down a wormhole on this)

Obviously there are often tax implications associated with rebalancing your portfolio in most jurisdictions, but that is beyond the scope of this post. We're simply going to focus on the "how", this guide is a) not tax advice, and b) not financial advice.

If you'd like, imagine this is all taking place in a tax-advantaged retirement account (yes, you can hold crypto in an IRA if that's your jam).

The annoying part of rebalancing a portfolio is translating desired portfolio weights (eg. 60% stocks, 40% bonds) into the actual quantities of each asset you need to buy or sell.

Not going to bury the lede any further – here are the basic steps to rebalancing a portfolio. This assumes you already know what assets you own or want to own.

- Consider your asset allocation and rebalancing strategy.

- Based on step 1, determine your target weights for each asset in your portfolio. The options are endless here, but here are a few common examples:

- Equal Dollar Weight – classic and simple. Each asset is assigned weight 1/n, where n is the number of positions in the portfolio

- Equal Risk (Volatility) Weight – The math gets a little more involved, but the idea remains simple. Each asset's weight is inversely proportional to its contribution to portfolio volatility. The more volatile and asset is, the lower its weight will be.

- Custom – This would be a target allocation like the 60/40 example from above, or 80/20 for someone younger, etc.

- Multiply those prices by your new weights to get the post-rebalance target dollar value of each asset.

- Pull the current price for each asset.

- For each asset, divide the dollar value by the unit price from step 4 to get the quantity you'll need to have. You'll need to iteratively reassign the remainder cash across assets until you're as close as possible to your new target weights (obviously this is a nonissue for crypto which is almost infinitely divisible).

- Take your new quantities and subtract your existing holdings. This is quantity of each asset you'll need to buy and sell.

- Execute your rebalancing trades.

- Rejoice! For you are balanced.

Those are the basic steps. You can see that step 5 gets a little hairy! It can be a huge pain. Even more-so in today's world where an increasing number of investors hold a mix of traditional and crypto assets across numerous brokerage accounts and exchanges.

That's where the Macro Sherpa Portfolio Rebalancing Calculator comes in handy. Whether you're using a pre-defined algorithm, or have your own asset allocation, this free web-based portfolio rebalancing software:

- does all the maths,

- pulls in live prices (110,000+ asset coverage universe),

- iteratively allocates your capital to get to your target weights,

- and spits out a trade blotter with exact Buy/Sell quantities you can take action on immediately.

Zero guess work. No flipping between your broker's website and a crusty excel sheet. Pretty clean mobile experience too.

"We just call the shots while simply moving our thumbs" – Sean Carter

Let's take it for a spin.

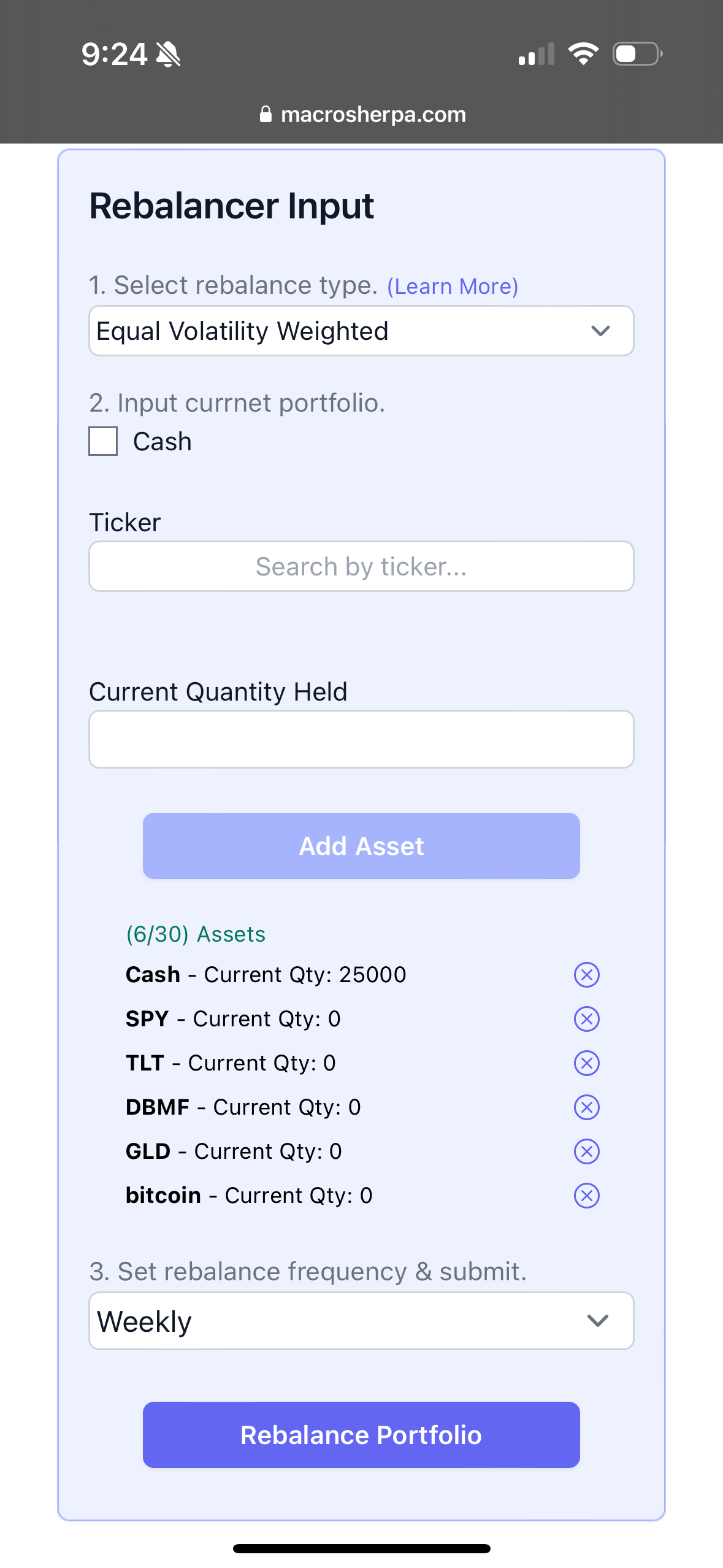

For our example we'll invest $25,000 in cash using an equal-risk weight algorithm across the S&P 500 (SPY), Long Term Treasury Bonds (TLT), Commodity Trend Following (DBMF), Gold (GLD), and Bitcoin.

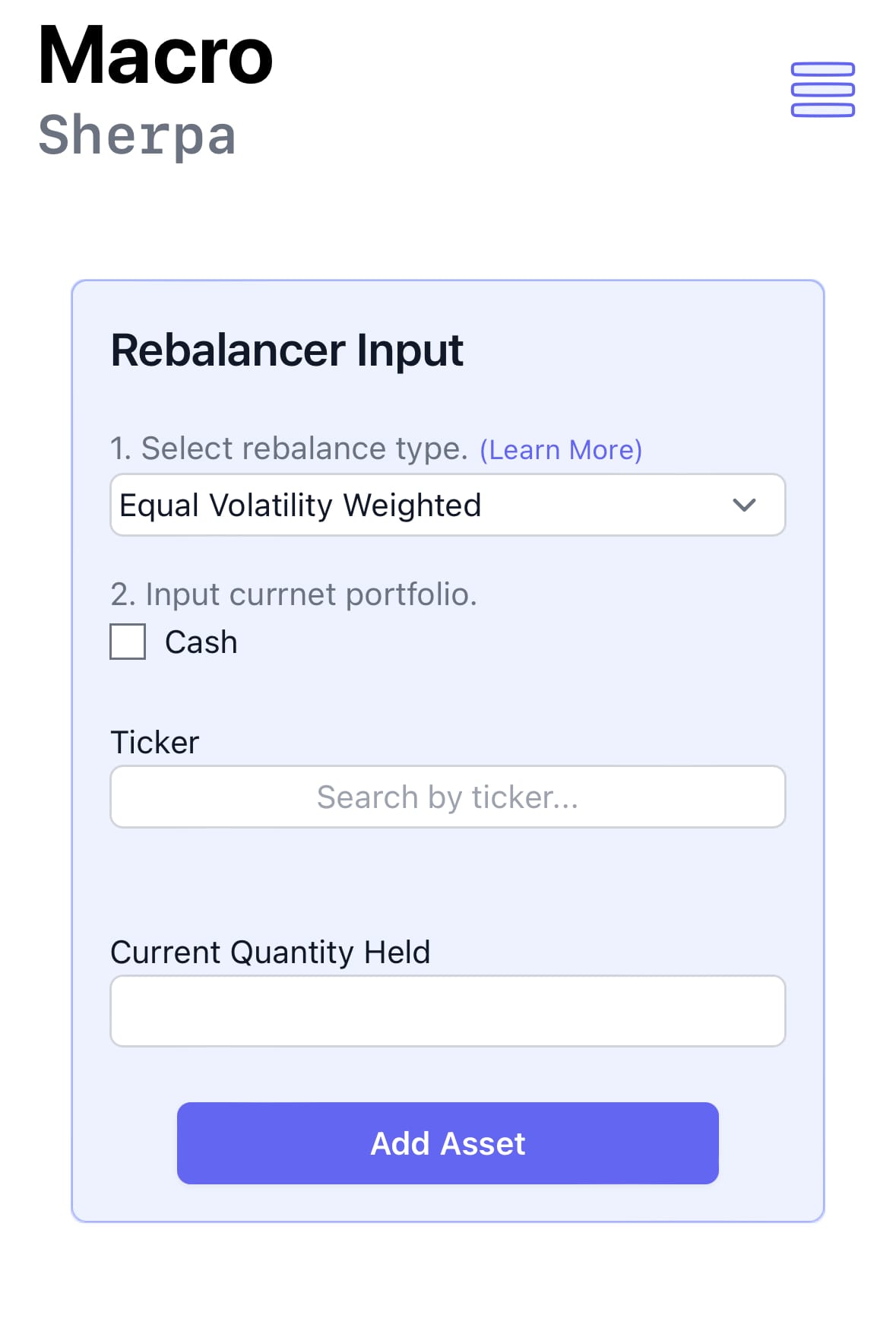

Here's the input card.

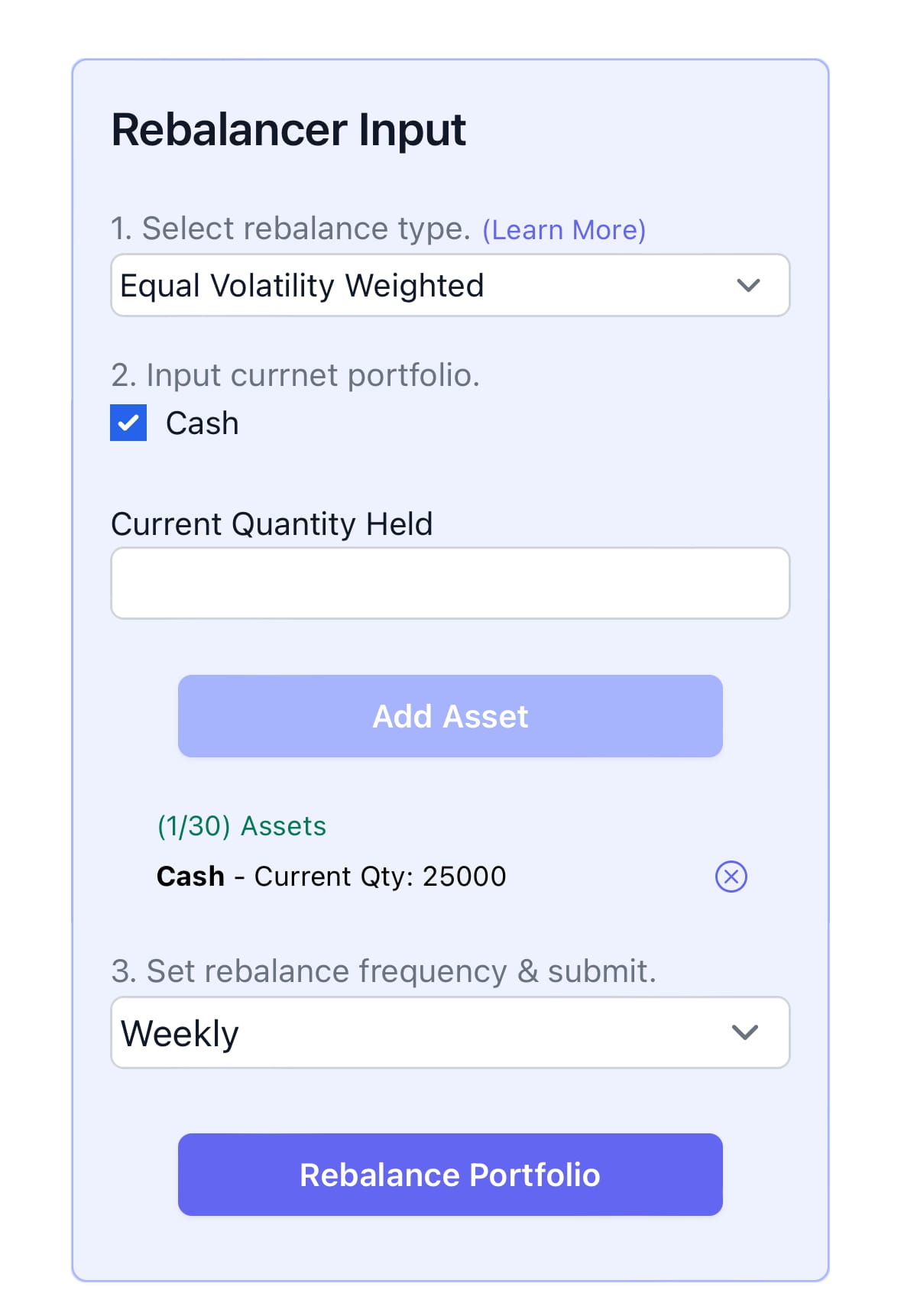

Let's add our starting capital of $25,000.

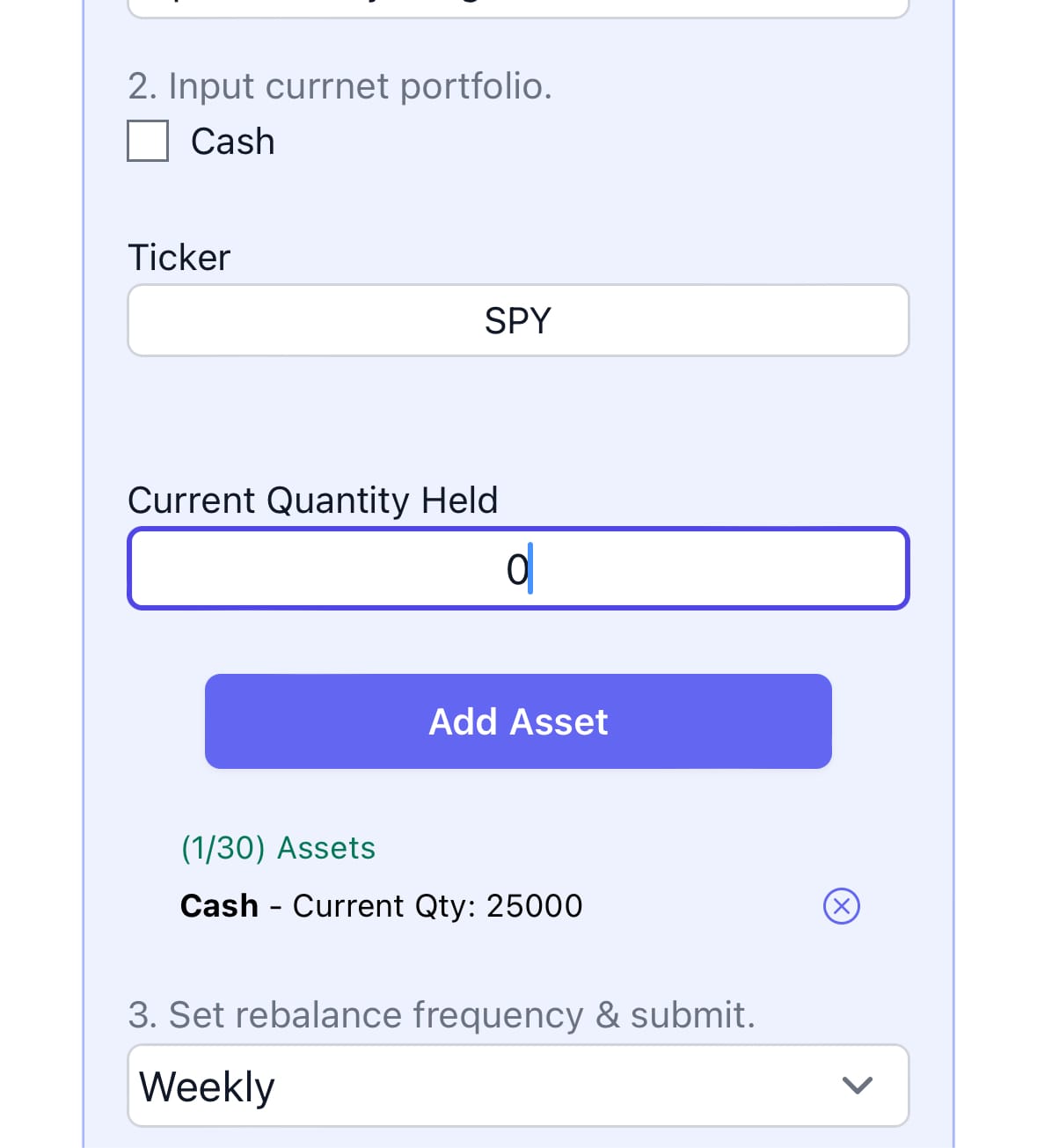

Now we start adding our other assets, one by one. Since we're starting with all cash, we set current quantity to 0.

With everything staged, we can double check our assets, change our frequency if desired, and then click Rebalance.

Few different views in our output.

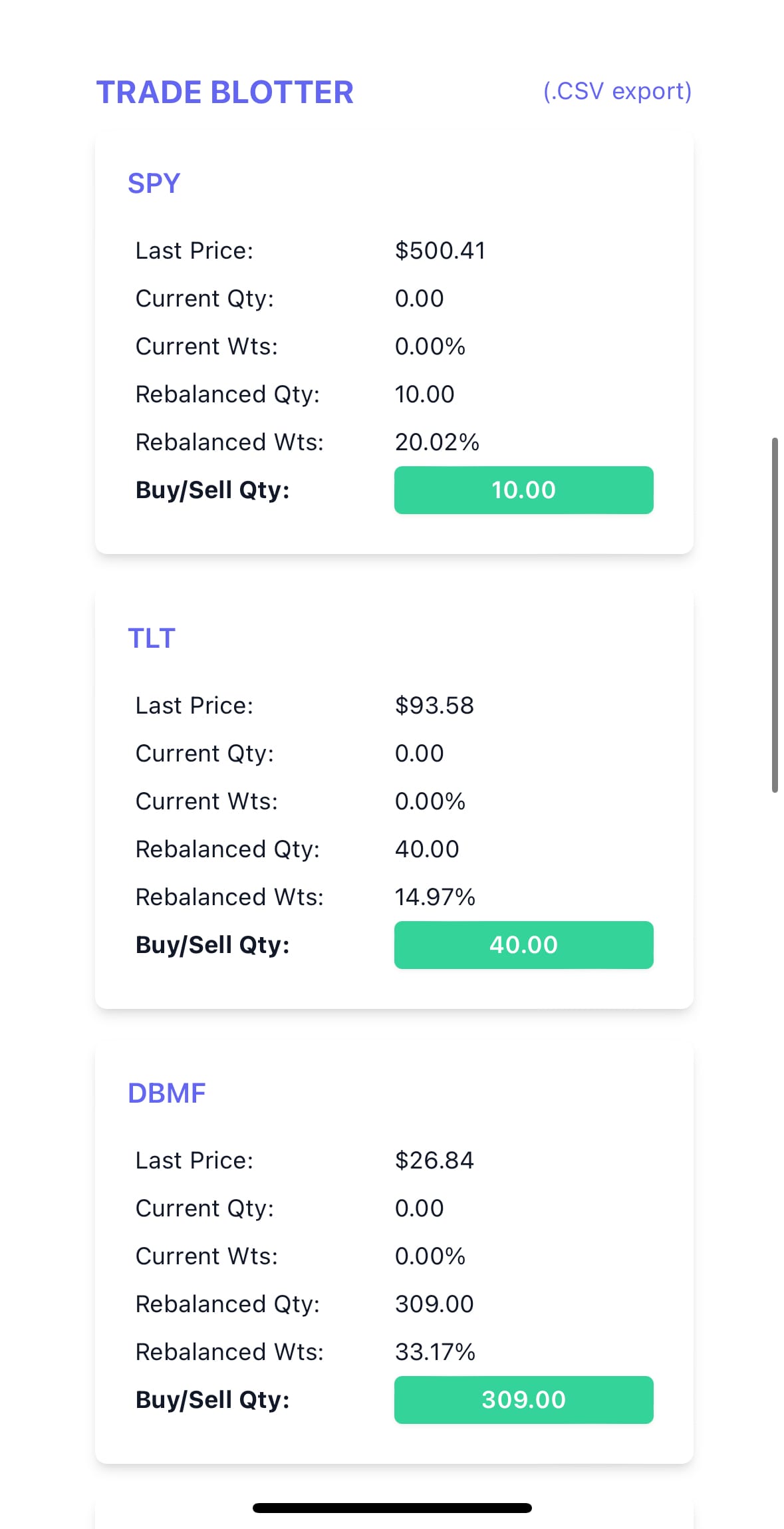

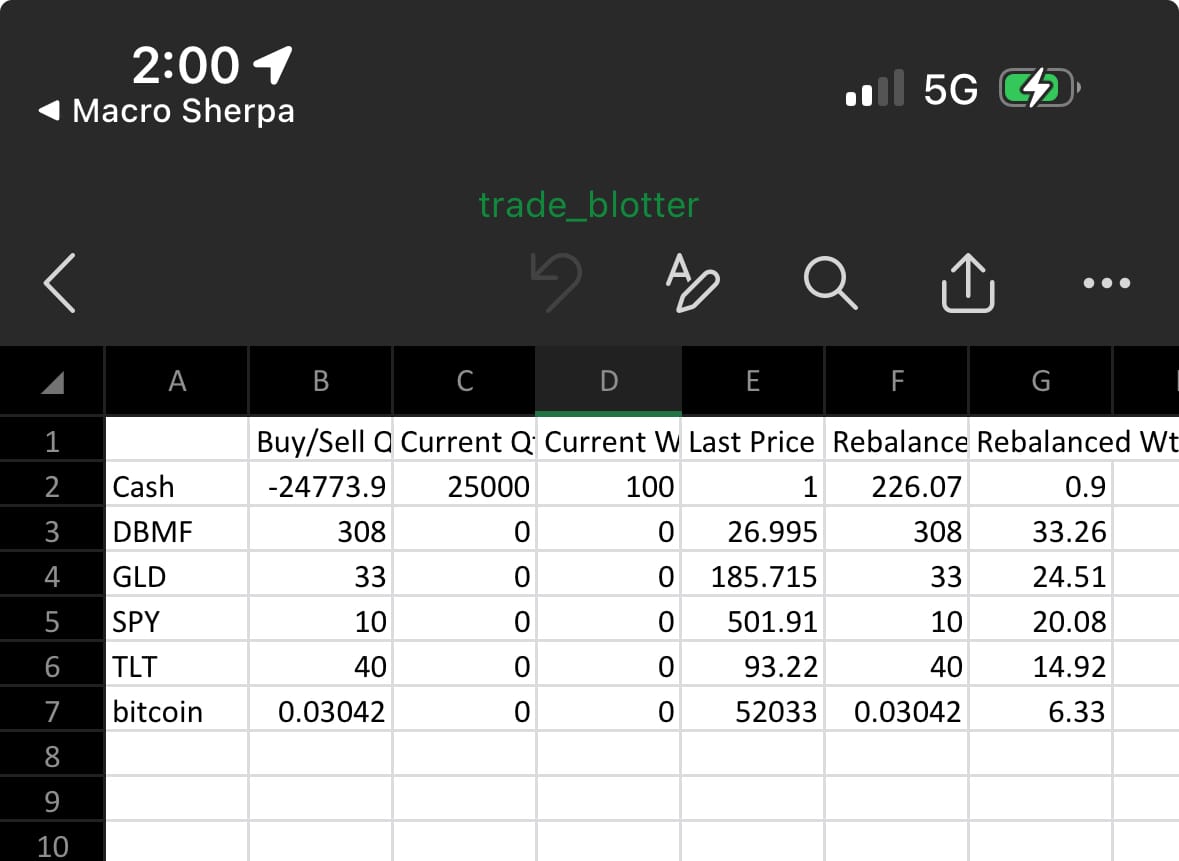

- The dashboard with the last price, weights, and buy/sell quantities. Desktop users will see a table.

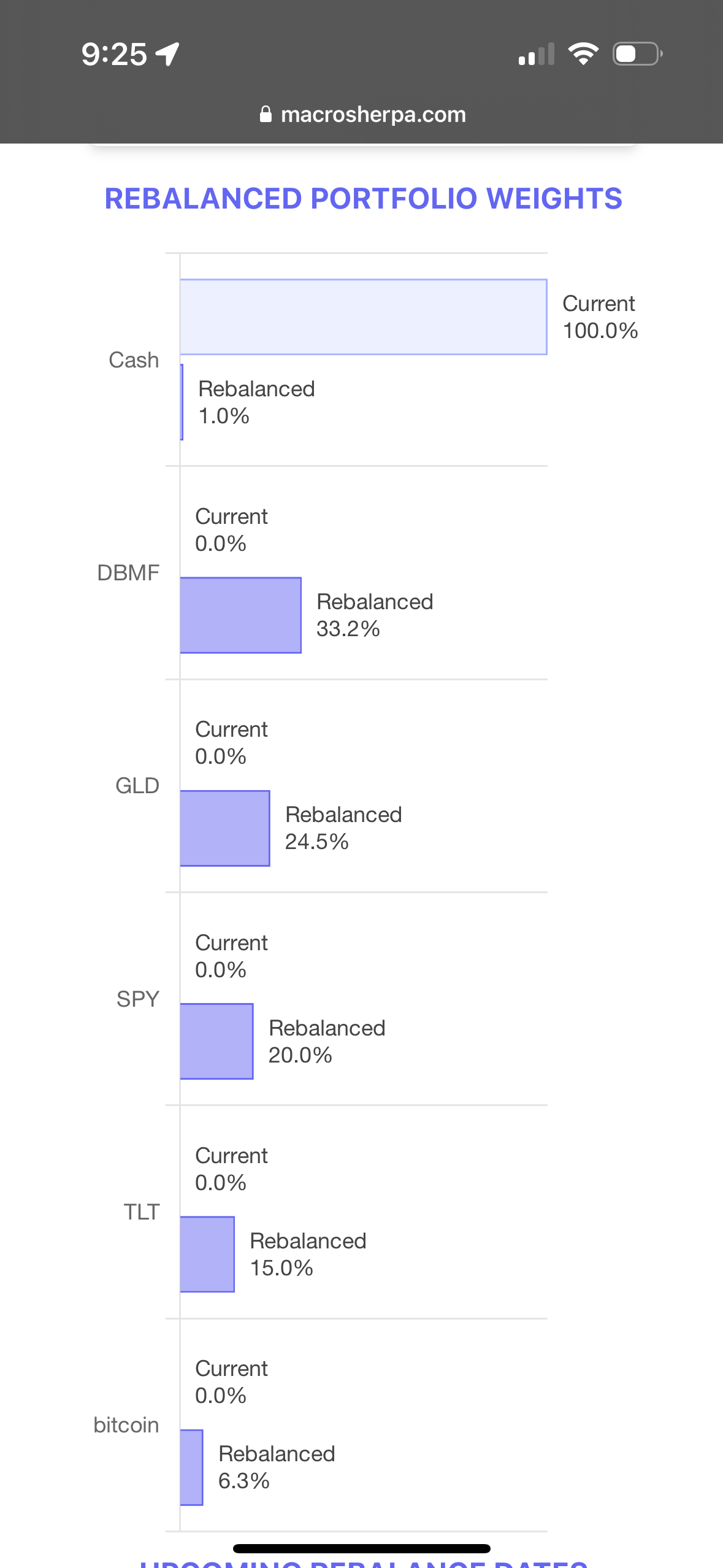

- A chart visualizing the redistribution of capital based on our rebalancing strategy. Note how the cash balance went from 100% to just about 0% and that the most volatile asset (bitcoin) has the lowest weight.

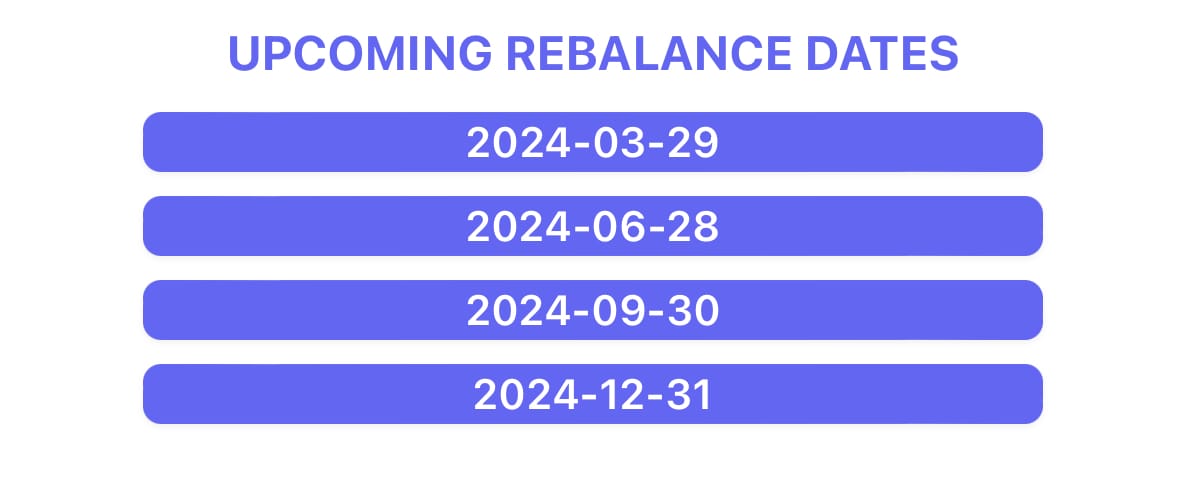

- Future rebalancing dates based on the frequency selected. (We are considering an SMS/email reminder feature in the future.)

- The Trade Blotter .csv file.

Macro Sherpa Portfolio Rebalance Calculator output dashboard and trade blotter CSV file.

That's it. The hope with this tool is to make it easier for self-guided sophisticated investors to keep their portfolios in line as the market winds and father time come for us all.

Dial in your asset allocation today with Macro Sherpa's Portfolio Rebalancing Calculator.

cheers,

macro sherpa